Default Investment Strategy

The Default Investment Strategy ("DIS") was launched on 1 April 2017.

DIS is a ready-made investment arrangement as stipulated in accordance with the Mandatory Provident Fund Schemes Ordinance mainly designed for those members who are not interested or do not wish to make a fund selection, and is also available as an investment choice itself for members who find it suitable for their own circumstances. The DIS is not a fund - it is a strategy that uses two constituent funds, namely the Core Accumulation Fund and the Age 65 Plus Fund to automatically reduce members’ risk exposure as members approach their retirement age through investing in the DIS Funds according to the pre-set allocation percentages specified by law. The DIS is required by law to be offered in every MPF scheme and is designed to be substantially similar in all MPF schemes. However, members should note that DIS does not provide guarantee on the capital and investment return and, therefore, members may suffer investment risk or loss involved from the investments in DIS.

Features of DIS

Asset Allocation

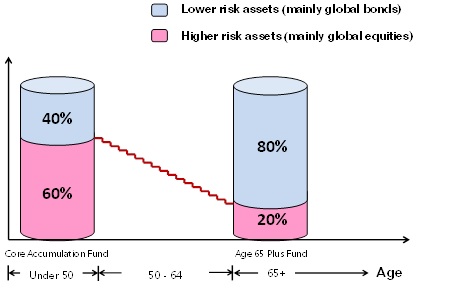

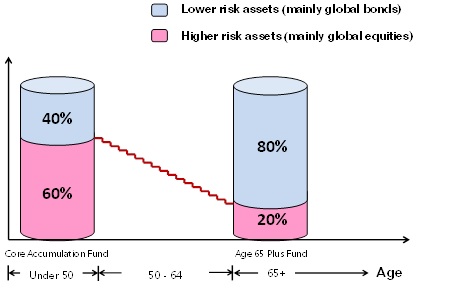

The DIS aims to balance the long term effects of risk and return through investing in two constituent funds, namely the Core Accumulation Fund (“CAF”) and the Age 65 Plus Fund (“A65F”), according to the pre-set allocation percentages at different ages.

The CAF will invest around 60% in higher risk assets (higher risk assets generally mean equities or similar investments) and 40% in lower risk assets (lower risk assets generally mean bonds or similar investments) of its net asset value.

Whereas the A65F will invest around 20% in higher risk assets and 80% in lower risk assets.

The DIS Funds adopt globally diversified investment principles and use different classes of assets, including global equities, fixed income, money market and cash, and other types of assets allowed under the MPF legislation.

Automatic De-risking Mechanism

Accrued benefits invested through the DIS will be invested in a way that adjusts risk depending on a member’s age. The DIS will manage investment risk exposure by automatically reducing the exposure to higher risk assets and correspondingly increasing the exposure to lower risk assets as the member gets older. Diagram 1 below shows the target proportion of investment in riskier assets over time.

Diagram 1: Asset Allocation between the DIS Funds according to the DIS

Note: The exact proportion of the portfolio in higher / lower risk assets at any point in time may deviate from the target glide path due to market fluctuations.

Under the DIS:

1.When a member is below the age of 50, all accrued benefits, future contributions and accrued benefits transferred from another scheme (“Future Investments”) will be invested in the CAF.

2.When a member is between the ages of 50 and 64, all accrued benefits and Future Investments will be invested according to the allocation percentages between the CAF and A65F as shown in the DIS de-risking table (as per Diagram 2 below). The de-risking of the existing accrued benefits and Future Investments will be automatically carried out as described above.

3.When a member reaches the age of 64, all accrued benefits and Future Investments will be invested in the A65F.

Diagram 2: DIS De-risking Table

| Age |

BCOM Core Accumulation Fund (“CAF”) |

BCOM Age 65 Plus Fund (“A65F”) |

| Below 50 |

100.0% |

0.0% |

| 50 |

93.3% |

6.7% |

| 51 |

86.7% |

13.3% |

| 52 |

80.0% |

20.0% |

| 53 |

73.3% |

26.7% |

| 54 |

66.7% |

33.3% |

| 55 |

60.0% |

40.0% |

| 56 |

53.3% |

46.7% |

| 57 |

46.7% |

53.3% |

| 58 |

40.0% |

60.0% |

| 59 |

33.3% |

66.7% |

| 60 |

26.7% |

73.3% |

| 61 |

20.0% |

80.0% |

| 62 |

13.3% |

86.7% |

| 63 |

6.7% |

93.3% |

| 64 and above |

0.0% |

100.0% |

Note: The above allocation between the CAF and A65F is made at the point of annual de-risking and the proportion of the CAF and A65F in the DIS portfolio may vary during the year due to market fluctuations.

Fees and out-of-pocket expenses of the CAF and A65F

The aggregate of the payments for services of the CAF and A65F must not, in a single day, exceed a daily rate of 0.75% per annum of the net asset value (“NAV”) of each of the DIS Funds divided by the number of days in the year. It includes, but is not limited to, the fees paid or payable for the services provided by the Approved Trustee, the Custodian, the Administrator, the Investment Manager and the Sponsor of the Scheme and the underlying investment funds of the respective DIS Funds, and any of the delegates from these parties and such fees are calculated as a percentage of the NAV of each of the DIS Funds and its underlying investment fund(s), but does not include any out-of-pocket expenses incurred by each DIS Fund and its underlying investment fund(s).

The total amount of all payments that are charged to or imposed on the DIS Funds or members who invest in DIS Funds, for out-of-pocket expenses incurred by the Approved Trustee on a recurrent basis in the discharge of the Approved Trustee’s duties to provide services in relation to the DIS Funds, shall not in a single year exceed 0.2% of the NAV of each of the DIS Funds. For this purpose, out-of-pocket expenses include, for example, annual audit expenses, printing or postage expenses relating to recurrent activities (such as issuing annual benefit statements), recurrent legal and professional expenses, safe custody charges which are customarily not calculated as a percentage of NAV and transaction costs incurred by a DIS Fund in connection with recurrent acquisition of investments for the DIS Fund (including, for example, costs incurred in acquiring underlying investment funds) and annual statutory expenses (such as compensation fund levy where relevant) of the DIS Fund.

Members should note that out-of-pocket expenses that are not incurred on a recurrent basis may still be charged to or imposed on the CAF and the A65F. Such fees are not subject to the statutory caps mentioned in the preceding paragraphs.

Implications on Members

(a) Implications on accounts opened on or after 1 April 2017

1. When members join the Scheme or set up a new account in the Scheme on or after 1 April 2017, they have the opportunity to give a specific investment instruction for their Future Investments. Members may choose to invest their Future Investments into:

the DIS; or

one or more CFs of their own choice from the list of constituent funds (including the CAF and the A65F*) and according to their assigned allocation percentage(s) to relevant fund(s) of their choice.

* If members choose the CAF and / or A65F as standalone fund choice rather than as part of the DIS, those investments will not be subject to the de-risking process.

2. If members cannot or do not want to provide a specific investment instruction to BOCOM Trustee at the time of their requests to join / set up a new account in the Scheme, their Future Investments will be automatically invested into the DIS.

(b) Implications on accounts opened before 1 April 2017

There are special rules to be applied for pre-existing accounts and these rules only apply to members who are under or becoming 60 years of age on 1 April 2017.

1.For a member’s pre-existing account with all accrued benefits being invested into the existing default investment arrangement since no investment instruction being given (known as “DIA account”):

There are special rules and arrangements to be applied to determine whether accrued benefits and Future Investments in a DIA account will be transferred to the DIS. If your pre-existing account is considered as a DIA account, you will receive a notice called the DIS Re-investment Notice (“DRN”) explaining the impacts on your pre-existing account and giving you an opportunity to give a specific investment instruction to BOCOM Trustee before the accrued benefits are invested into the DIS.

For details of the arrangement, members should refer to the DRN.

2. For a member’s pre-existing account with part of the accrued benefits in the original default investment arrangement:

Unless the Trustee has received any specific investment instructions, the member's accrued benefits as well as Future Investments paid to the member's pre-existing account on or after 1 April 2017 will be invested in the same manner as at 31 March 2017.

(c) Special circumstances

Where the accrued benefits in the pre-existing account are transferred from another account within the Scheme (e.g. in the case of cessation of employment, where accrued benefits in member’s contribution account are transferred to a personal account within the Scheme), member’s accrued benefits in the pre-existing account will be invested in the same manner as they were invested immediately before the transfer but member’s Future Investments may be invested in the DIS after the implementation of the DIS, unless otherwise instructed.

Rules and Procedures of Annual De-Risking

BOCOM Trustee will adjust the asset allocation of the member on members’ birthday^ each year. If the member’s birthday is not on a Valuation Date, then the investments will be moved on the next available Valuation Date. Alternatively, if the member's birthday falls on the 29th of February and in the year which is not a leap year, then the investments will be moved on 1st of March or the next available Valuation Date.

^If BOCOM Trustee does not have the full date of birth of the relevant member:

If only the year and month of birth is available, the annual de-risking will use the last calendar day of the birth month, or if it is not a Valuation Date, the next available Valuation Date.

If only the year of birth is available, the annual de-risking will use the last calendar day of the year, or if it is not a Valuation Date, the next available Valuation Date.

If no information at all on the date of birth, member’s accrued benefits will be fully invested in A65F with no de-risking applied.

When one or more of the specified instructions (including but not limited to subscription, redemption or switching instructions) are received prior to or on the annual date of de-risking for a relevant member and being processed on that date, the annual de-risking may be deferred and the annual de-risking will only take place after completion of these specified instructions.

If there is any exceptional circumstance, e.g. market closure or suspension of dealing, which makes it impossible for the investments to be moved on that day, the investments will be moved on the next available Valuation Date.

Relevant notice to customers

BOCOM Trustee has sent the relevant notice to members to ensure that the scheme members understand the impact of the DIS on their MPF accounts.

| Date |

Details |

Target |

| November 2016 |

Issue notice to affected members to explain the impact of DIS on them and remind members updating the contact details and date of birth |

Potential DIA account |

| December 2016 |

Issue notice to affected members to explain the impact of DIS on them and remind members updating the contact details and date of birth |

Members whose accrued benefit with zero balance and invested in default investment arrangement upon enrolment |

| December 2016 |

Issue notice to affected members to explain the impact of DIS on them and remind members updating the contact details and date of birth |

Members with same scheme transfer or transferred to Personal Account automatically |

| January 2017 |

Issue DIS Pre-implementation Notice to all scheme members explaining the impact of DIS on them |

All scheme members |

| 7 April 2017 |

Issue DRN to affected scheme members. If members do not reply within 42 days after issuance of DRN, the accrued benefits and Future Investments in the scheme member’s account will be re-invested in accordance with the DIS. |

Potential DIA account who are under or becoming 60 years of age on 1 April 2017 |

If you have further enquiry in relation to the DIS, please click here for the FAQ or contact us at 2905 8708 / 2905 8584.

For more details regarding the DIS and the Scheme, please click the following links:

MPF Scheme Brochure

DIS Pre-Implementation Notice to Participating Employers and Members

Get To Know The eMPF Platform

Mandatory Provident Fund Scheme

Joyful Smart Personal Contribution

Get To Know The eMPF Platform

Mandatory Provident Fund Scheme

Joyful Smart Personal Contribution

Fund Custody and Administration Services

HK SFC Authorized Fund Trustee Services

Offshore Bond Custody Services

Fund Custody and Administration Services

HK SFC Authorized Fund Trustee Services

Offshore Bond Custody Services

QFI Custody Services

QDII & RQDII Custody Services

Bond Connect Custody Services

QFI Custody Services

QDII & RQDII Custody Services

Bond Connect Custody Services