Fund Choice

Important Notes

|

|

1.

|

The BCOM Joyful Retirement MPF Scheme ("Scheme") is a registered MPF Scheme.

|

|

2.

|

Investment involves risks and not all investment choices available under the Scheme would be suitable for everyone. There is no assurance on investment returns and your investments / accrued benefits may suffer significant loss.

|

|

3.

|

The BCOM Guaranteed (CF) Fund in the Scheme is a capital and return guaranteed fund. Where participation to this constituent fund is less than 60 months, the repayment of capital and return on investment are not guaranteed and the withdrawal values are fully exposed to fluctuations in the value of the constituent fund’s asset. The Bank of Communications Co. Ltd., Hong Kong Branch is the guarantor to this constituent fund. Your investments are therefore subject to the credit risks of the guarantor. Please refer to the sub-section "3.2 BCOM Guaranteed (CF) Fund" under the sub-section "3. Statements of investment policies" under the section "III. FUND OPTIONS, INVESTMENT OBJECTIVES AND POLICIES" and Appendix 1 to this MPF Scheme Brochure for details of the guarantee features and guarantee conditions.

|

|

4.

|

You should consider your own risk tolerance level and financial circumstances before making any investment choices. When, in your selection of constituent funds, you are in doubt as to whether a certain constituent fund is suitable for you (including whether it is consistent with your investment objectives), you should seek financial and / or professional advice and choose the constituent fund(s) most suitable for you taking into account your circumstances. In the event that you do not make any investment choices, please be reminded that your contributions made and / or benefits transferred into the Scheme will be invested into the MPF default investment strategy ("DIS"), and the DIS may not necessarily be suitable for you.

|

|

5.

|

You should consider your own risk tolerance level and financial circumstances before investing in the DIS. You should note that the BCOM Core Accumulation Fund and the BCOM Age 65 Plus Fund may not be suitable for you, and there may be a risk mismatch between the BCOM Core Accumulation Fund and the BCOM Age 65 Plus Fund and your risk profile (the resulting portfolio risk may be greater than your risk preference). You should seek financial and/or professional advice if you are in doubt as to whether the DIS is suitable for you, and make the investment decision most suitable for you taking into account your circumstances.

|

|

6.

|

You should note that the implementation of the DIS may have an impact on your MPF investments and benefits. You should consult with the Approved Trustee if you have doubts on how you are being affected.

|

|

7.

|

Please do not invest based on this website alone. For further details including the product features, investment policies, investment objectives, charges and risks involved, please refer to the MPF Scheme Brochure of the Scheme.

|

We have been launching a series of constituent funds with different investment objectives and in various risk levels for your appropriate selection.

BCOM Joyful Retirement MPF Scheme

§ BCOM MPF Conservative Fund

§ BCOM Guaranteed (CF) Fund

§ BCOM Global Bond (CF) Fund

§ BCOM Stable Growth (CF) Fund

§ BCOM Balanced (CF) Fund

§ BCOM Dynamic Growth (CF) Fund

§ BCOM Core Accumulation Fund

§ BCOM Age 65 Plus Fund

§ BCOM Asian Dynamic Equity (CF) Fund

§ BCOM HSI ESG Tracking (CF) Fund

§ BCOM Hong Kong Dynamic Euity (CF) Fund

§ BCOM Greater China Equity (CF) Fund

§ BCOM China Dynamic Equity (CF) Fund

§ BCOM North American Equity (CF) Fund

|

1.

|

Risk inherent is determined by Bank of Communications Trustee Limited based on the constituent funds’ volatility and the percentage of the constituent funds being invested in equities and will be reviewed regularly. The risk inherent is provided for reference only and has not taken into account investors’ own risk tolerance level and financial circumstances. Whilst the risk inherent may be considered by investors in their analysis of the constituent funds, it is nonetheless the obligation of each investor to ensure that a constituent fund is suitable for him / her. Investors cannot therefore substitute their own judgment / assessment of the constituent funds with the risk inherent provided by the Bank of Communications Trustee Limited who determines the risk inherent.

|

|

2.

|

The below ranges of asset and geographic allocations are for indication only and actual allocation may at times be varied from that shown below as market, economic and other conditions change.

|

|

BCOM MPF Conservative Fund

|

|

The investment objective of the constituent fund is to

obtain a return that is higher than the prescribed savings rate.

|

|

Feature

|

|

§ Type of the

constituent fund: Money Market Fund

|

|

§ The

constituent fund will invest in Hong Kong dollar denominated bank deposits

and short-term debt securities subject to the requirements of Section 37 of

the Mandatory Provident Fund Schemes (General) Regulation

|

|

§ Risk

inherent: Little

|

|

§ The

structure of the constituent fund: takes the form of an internal portfolio

fund

|

|

§ Investment

Manager: BCOM Finance (Hong Kong) Limited

|

|

Asset Allocation

|

|

§ Debt

Securities: 0% - 50%

|

|

§ Cash &

Deposits: 50% - 100%

|

|

Geographic Allocation

|

|

Fees and charges of MPF conservative fund can be

deducted from either (i) the assets of the constituent fund or (ii) members'

account by way of unit deduction. Effective from 1 January 2023, BCOM MPF Conservative Fund uses method (i)

and, therefore, unit prices / NAV / constituent fund performance quoted

(except for the constituent fund performance figures quoted in a fund fact

sheet) reflect the impact of fees and charges.

|

|

BCOM Guaranteed (CF) Fund

|

|

The investment objective of the

constituent fund is to achieve long-term capital growth.

|

|

Feature

|

|

§ Type of the constituent fund: Guaranteed Fund

|

|

§ The constituent fund will invest in a diversified

portfolio comprising cash and deposits, debt securities, equities and

authorized unit trusts |

|

§ Risk inherent: Relatively low

|

|

§ Structure of the constituent fund: takes the form of an

internal portfolio fund

|

|

§ Investment Manager: BCOM Finance (Hong Kong) Limited

|

|

§ The BCOM Guaranteed (CF) Fund in the Scheme is a capital and return guaranteed fund. Bank of Communications Co., Ltd. Hong Kong Branch is

the guarantor to this constituent fund. Your investments are subject to the

credit risks of the guarantor. The guarantor will declare the guaranteed rate

of return on each Accounting Date of a financial year, i.e. 31 Dec, and in no

event shall the guaranteed rate of return be lower than 1% p.a.. The

guaranteed rate of return for financial year 2023 is 1% p.a.. Where

participation in the constituent fund is less than 60 months, the repayment

of capital and return on investment are not guaranteed and the withdrawal

values are fully exposed to fluctuations in the value of the constituent

fund's assets. The constituent fund includes a pre-announcement mechanism.

Please refer to the sub-section "3.2 BCOM Guaranteed (CF) Fund" under the sub-section "3. Statements of investment policies" under the section "III. FUND OPTIONS, INVESTMENT OBJECTIVES AND POLICIES" and Appendix 1 to this MPF Scheme Brochure for details of the guarantee features and guarantee conditions. |

|

Asset Allocation

|

|

§ Debt Securities^: 25% - 85%

|

|

§ Equities^: 5% - 35%

|

|

§ Authorized Unit Trusts: 0% - 10%

|

|

§ Cash & Deposits: 0% - 55%

|

|

^ including relevant

index-tracking collective investment scheme approved by the MPFA

|

|

Geographic Allocation

|

Hong Kong

|

30% - 100%

|

|

Mainland China

|

0% - 50%

|

|

Supranational & G7 countries

|

0% - 30%

|

|

Others

|

0% - 20%

|

|

|

BCOM Global Bond (CF) Fund

|

|

The constituent fund aims to achieve

steady growth over the long term through investment in a portfolio of global

bonds.

|

|

Feature

|

|

§ Type of the constituent fund: Bond Fund - Global

|

|

§ The constituent fund will invest in the relevant

approved pooled investment fund(“APIF”), MPF Bond Fund of Invesco Pooled

Investment Fund, which is a fund of funds managed by Invesco Hong Kong

Limited. The principal underlying investments of the constituent fund

will be in global bonds and HK dollar denominated bonds

|

|

§ Risk inherent : Low

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Invesco Hong Kong Limited

|

|

Asset Allocation

|

|

§ Global Bonds: 50% - 90%

|

|

§ HK dollar denominated Bonds: 10% - 50%

|

|

BCOM Stable Growth (CF) Fund

|

|

The objective of the constituent fund is to achieve a

long-term return in excess of Hong Kong price inflation (as measured by the

Consumer Price Index Type A).

|

|

Feature

|

|

§ Type of the

constituent fund: Mixed Assets Fund (Global) - Equity : Maximum 60%

|

|

§ The

constituent fund will seek to achieve the objective through investing its

assets in the relevant APIF, Schroder MPF Stable Growth Fund, which is a fund

of funds managed by Schroder Investment Management (Hong Kong) Limited. The

principal underlying investments of the constituent fund will be in

quoted securities, government and corporate bonds and cash deposits worldwide

|

|

§ Risk

inherent: Medium. It is suitable for investors with between 5 and 10 years

before retirement

|

|

§ Structure of

the constituent fund: Feeder Fund

|

|

§ Investment

Manager: Schroder Investment Management (Hong Kong) Limited

|

|

Asset Allocation

|

|

§ Bonds: 20% -

60%

|

|

§ Equities:

30% - 60%

|

|

§ Cash or cash

equivalents: 0% - 20%

|

|

Geographic Allocation

|

Bonds

|

20% - 60%

|

|

US Dollar

|

5% - 55%

|

|

Global Currencies

(ex US Dollar & ex Hong Kong Dollar)

|

5% - 60%

|

|

Hong Kong Dollar

|

0% - 30%

|

| |

|

|

Equites

|

30% - 60%

|

|

Hong Kong

|

5% - 30%

|

|

Asia (ex

Hong Kong & ex Japan)

|

0% - 15%

|

|

United

States

|

0% - 25%

|

|

Japan

|

0% - 15%

|

|

Europe

|

0% - 15%

|

|

Others

|

0% - 5%

|

| |

|

|

Cash or cash

equivalents

|

0% - 20%

|

| |

|

|

|

BCOM Balanced (CF) Fund

|

|

The objective of the constituent fund is to achieve a long-term return in excess of Hong Kong salary inflation (as indicated by the Hong Kong Monthly Digest of Statistics as published by the Census and Statistics Department of the Government of Hong Kong Special Administrative Region).

|

|

Feature

|

|

§ Type of the constituent fund: Mixed Assets Fund (Global) - Equity : Maximum 85%

|

| § The constituent fund will seek to achieve the objective through investing its assets in the relevant APIF, Schroder MPF Balanced Investment Fund, which is a fund of funds managed by Schroder Investment Management (Hong Kong) Limited. The principal underlying investments of the constituent fund will be in quoted securities, government and corporate bonds and cash deposits worldwide |

|

§ Risk inherent: Relatively High. It is suitable for investors with more than 10 years before retirement

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Schroder Investment Management (Hong Kong) Limited

|

|

Asset Allocation

|

|

§ Bonds: 0% - 40%

|

|

§ Equities: 45% - 85%

|

|

§ Cash or cash equivalents: 0% - 20%

|

|

Geographic Allocation

|

Bonds

|

0% - 40%

|

|

US Dollar

|

0% - 25%

|

|

Global Currencies

(ex US Dollar & ex Hong Kong Dollar)

|

0% - 40%

|

|

Hong Kong Dollar

|

0% - 20%

|

| |

|

|

Equites

|

45% - 85%

|

|

Hong Kong

|

10% - 40%

|

|

Asia (ex Hong Kong & ex Japan)

|

0% - 25%

|

|

United States

|

5% - 30%

|

|

Japan

|

0% - 20%

|

|

Europe

|

0% - 25%

|

|

Others

|

0% - 10%

|

| |

|

|

Cash or cash equivalents

|

0% - 20%

|

| |

|

|

|

BCOM Dynamic Growth (CF) Fund

|

|

The constituent fund aims to

maximize long term overall returns by investing primarily in global equities.

|

|

Feature

|

|

§ Type of the constituent fund: Mixed Assets Fund

(Global) - Equity: Maximum 100%

|

|

§ The constituent fund will achieve its investment

objectives by investing all its assets in an

APIF, Allianz Choice Growth Fund of Allianz Global Investors

Choice Fund, which is a fund of funds managed by Allianz Global Investors

Asia Pacific Limited. The APIF may invest in the countries comprised in the

MSCI World Index which covers all the major world stock markets including

those in Japan, North America, Asia and Europe

|

|

§ Risk inherent: Relatively high

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Allianz Global Investors Asia

Pacific Limited

|

|

Asset Allocation

|

|

§ Global Equities: 80% - 100%

|

|

§ Cash* & Fixed-interest securities: 0% - 20%

|

|

*For ancillary purposes

|

|

BCOM Core Accumulation Fund

|

|

The objective of the constituent

fund is to provide capital growth to members by investing in a globally

diversified manner.

|

|

Feature

|

|

§ Type of the constituent fund: Mixed Assets Fund

(Global)

|

|

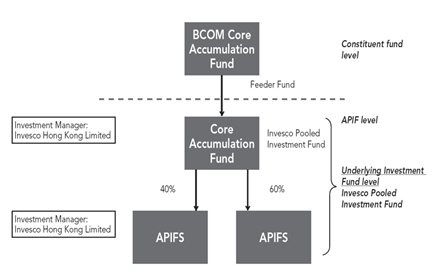

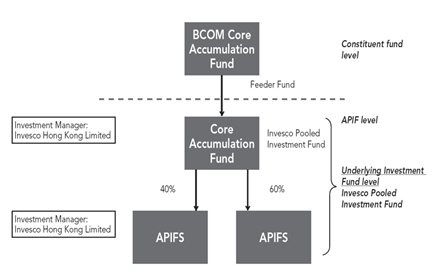

§ The constituent fund invests in an APIF, Core

Accumulation Fund under the Invesco Pooled Investment Fund managed by Invesco

Hong Kong Limited, which in turn invests in two APIFs. The underlying APIFs

adopt an active investment strategy. An active investment strategy aims to

promote efficiency and minimize cost for the purpose of DIS asset

rebalancing. The Fund will make reference to its Reference Portfolio.

|

|

Product structure chart illustrating

the fund structure of the BCOM Core Accumulation Fund:

|

|

|

|

§ Risk inherent: Medium to High

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Invesco Hong Kong Limited

|

|

Asset Allocation

|

|

§ Higher Risk Assets: 55% - 65%

|

|

§ Lower Risk Assets: 35% - 45%

|

|

BCOM Age 65 Plus Fund

|

|

The objective of the constituent

fund is to provide stable growth to members by investing in a globally

diversified manner.

|

|

Feature

|

|

§ Type of the constituent fund: Mixed Assets Fund

(Global)

|

|

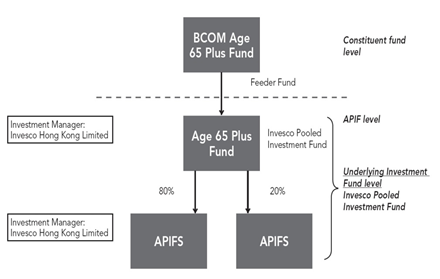

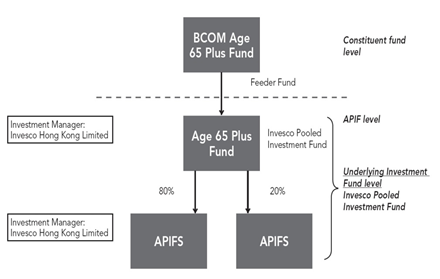

§ The constituent fund invests in an APIF, Age 65 Plus

Fund under the Invesco Pooled Investment Fund managed by Invesco Hong Kong

Limited which in turn invests in two APIFs. The underlying APIFs adopt an

active investment strategy. An active investment strategy aims to promote

efficiency and minimize cost for the purpose of DIS asset rebalancing. The

constituent fund will make reference to its Reference Portfolio.

|

|

|

Product structure chart illustrating

the fund structure of the BCOM Age 65 Plus Fund:

|

|

|

|

§ Risk inherent: Low to Medium

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Invesco Hong Kong Limited

|

|

Asset Allocation

|

|

§ Higher Risk Assets: 15% - 25%

|

|

§ Lower Risk Assets: 75% - 85%

|

|

BCOM Asian Dynamic Equity (CF) Fund

|

|

The constituent fund is to achieve

capital growth over the long-term by investing in Asian equity markets.

|

|

Feature

|

|

§ Type of the constituent fund: Equity Fund - Asia

|

|

§ The constituent fund will invest in an investment fund,

Principal Asian Equity Fund of Principal Unit Trust Umbrella Fund, managed by

Principal Asset Management Company (Asia) Limited. It is also an APIF. The

investment fund will in turn invest in another APIF which consists primarily

of Asian equities and can include exposure to cash and short-term investments

|

|

§ Risk inherent: High

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Principal Asset Management Company

(Asia) Limited

|

|

Asset Allocation

|

|

§ Equities: 70% - 100%

|

|

§ Cash & Short - term Investments (e.g. bills and

deposits): 0% - 30%

|

|

Geographic Allocation

|

Asia(ex-Japan)

|

80% - 100%

|

|

Others

|

0% - 20%

|

|

|

BCOM HSI ESG Tracking (CF) Fund

|

|

The objective of the constituent

fund is to provide investment results that, before deduction of fees and expenses,

closely correspond to the performance of the HSI ESG Enhanced Index (the "Index").

|

|

Feature

|

|

§ Type of the constituent fund: Equity Fund - Hong Kong

|

|

§ The BCOM HSI ESG Tracking (CF) Fund will seek to achieve its investment objective by investing its assets entirely in a single approved ITCIS, the E Fund (HK) HSI ESG Enhanced Index ETF, managed by E Fund Management (Hong Kong) Co., Limited.

|

|

§ The E Fund (HK) HSI ESG Enhanced Index ETF holds shares in

the constituent companies of the Index in substantially similar composition and weighting as they appear in the Index and may also invest in certain other permitted investments in seeking to meet the investment objective.

|

|

§ The Index is a free float adjusted market capitalization weighted index. The Index aims to combine the Index with ESG (environmental, social and governance) initiatives from international lens.

|

|

§ Risk inherent: High

|

§ Structure of the constituent fund: Feeder Fund

§ Investment Manager: E Fund Management (Hong Kong) Co., Limited

|

|

BCOM Hong Kong Dynamic Equity (CF)

Fund

|

|

The constituent fund is to achieve

capital growth over the long-term by investing mainly in Hong Kong equity

markets.

|

|

Feature

|

|

§ Type of the constituent fund: Equity Fund - Hong Kong

|

|

§ The constituent fund will invest in an investment fund,

Principal Hong Kong Equity Fund, managed by Principal Asset Management

Company (Asia) Limited. It is also an APIF. The investment fund will invest

primarily in listed equities issued by companies established in Hong Kong or

by companies whose shares are listed in Hong Kong (including but not limited

to H shares and shares of red-chip companies listed on the Hong Kong Stock

Exchange)

|

|

§ Risk inherent: High

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Principal Asset Management Company

(Asia) Limited

|

|

Asset Allocation

|

|

§ Equities: 70% - 100%

|

|

§ Cash & Short - term Investments (e.g. bills and

deposits): 0% - 30%

|

|

Geographic Allocation

|

Hong Kong/China

|

70% - 100%

|

|

Others

|

0% - 30%

|

|

|

BCOM Greater China Equity (CF) Fund

|

|

The constituent fund aims to achieve

long term capital growth by investing mainly in Greater China-related

equities.

|

|

Feature

|

|

§ Type of the constituent fund: Equity Fund - Greater

China

|

|

§ The constituent fund will invest in the relevant

APIF, Allianz Choice Greater China Fund of Allianz Global

Investors Choice Fund, managed by Allianz Global Investors Asia Pacific

Limited. The APIF invests primarily in the equity markets of Hong Kong and

Taiwan; or companies that derive a predominant portion of their revenue

and/or profits from Greater China Region, which includes Mainland China, Hong

Kong, Macau and Taiwan

|

|

§ Risk inherent: Relatively high

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Allianz Global Investors Asia

Pacific Limited

|

|

Asset Allocation

|

|

§ Equities: 70% - 100%

|

|

§ Cash & Short term fixed-interest securities *:

0-30%

|

|

* For cash management purpose

|

|

BCOM China Dynamic Equity (CF) Fund

|

|

The constituent fund is to achieve

capital growth over the long term by investing mainly in China-related

equities.

|

|

Feature

|

|

§ Type of the constituent fund: Equity Fund - China

|

|

§ The constituent fund will invest in an APIF, Principal

China Equity Fund, managed by Principal Asset Management Company (Asia)

Limited. The investment fund will invest primarily in equities issued by

companies with exposure in different sectors of economies in People's

Republic of China (Mainland China)

|

|

§ Risk inherent: High

|

|

§ Structure of the constituent fund: Feeder Fund

|

|

§ Investment Manager: Principal Asset Management Company

(Asia) Limited

|

|

Asset Allocation

|

|

§ Equities: 70% - 100%

|

|

§ Cash & Short - term Investments (e.g. bills and

deposits) *: 0% - 30%

|

|

Geographic Allocation

|

People's Republic of China

(Mainland China)

|

70% - 100%

|

|

Others

|

0% - 30%

|

* For cash management purpose

|

|

BCOM North American Equity (CF) Fund

|

|

The constituent fund is to seek long-term capital growth by investing in North American equity markets.

|

|

Feature

|

|

§ Type of the constituent fund: Equity Fund - North America

|

|

§ The constituent fund invests in a combination of approved ITCISs tracking North American equity market indices. However, the constituent fund is not an index-tracking fund

|

|

§ Approved ITCISs will be selected from those available in the market that will allow the constituent fund to achieve the stated investment objectives. The index providers of the respective equity market indices that are tracked by the underlying approved ITCISs are independent of Bank of Communications Trustee Limited, the trustee of the Scheme and E Fund Management (Hong Kong) Co., Limited, the investment manager of the constituent fund

§ The constituent fund may also invest in APIFs to provide exposure to cash and short-term investments

§ Risk inherent: Relatively high

|

|

§ Structure of the constituent fund: Portfolio management fund

|

|

§ Investment Manager: E Fund Management (Hong Kong) Co., Limited

|

|

Asset Allocation

|

|

§ Equities: 70% - 100%

|

|

§ Cash & Short - term Investments: 0% - 30%

|

|

Geographic Allocation

|

North American - The United States of America and Canada

|

70% - 100%

|

|

Others

|

0% - 30%

|

|

Mandatory Provident Fund Scheme

Joyful Smart Personal Contribution

Personal Account

Mandatory Provident Fund Scheme

Joyful Smart Personal Contribution

Personal Account

Fund Custody and Administration Services

HK SFC Authorized Fund Trustee Services

Offshore Bond Custody Services

Fund Custody and Administration Services

HK SFC Authorized Fund Trustee Services

Offshore Bond Custody Services

QFI Custody Services

QDII & RQDII Custody Services

Bond Connect Custody Services

QFI Custody Services

QDII & RQDII Custody Services

Bond Connect Custody Services